Buying your first home is one of the most exciting milestones in life – but it can also be a minefield of potential pitfalls. Many first time buyers in the UK make simple mistakes that cost them time, money, and even the house they want.

In this guide, we’ll cover the most common mistakes first time buyers make and share practical tips on how to avoid them.

1. Not Getting a Mortgage Agreement in Principle (AIP) First

The mistake: House-hunting before knowing exactly how much you can borrow.

Why it’s a problem: Without an AIP, you risk wasting time on homes outside your budget or losing out to buyers who are ready to proceed.

How to avoid it: Speak to a mortgage broker early to get your AIP. This gives you a clear budget and shows estate agents and sellers you’re serious. Read our blog post on AIPs, DIPs and MIPs.

2. Underestimating the Total Costs of Buying a Home

The mistake: Thinking your deposit is your only big expense.

Why it’s a problem: First time buyer costs can include solicitor fees, buildings surveys, mortgage product fees, removals, insurance and furnishing.

How to avoid it: Make a realistic budget that includes both one-off buying costs and ongoing monthly expenses.

3. Ignoring Your Credit Score

The mistake: Assuming your credit score won’t affect your mortgage application.

Why it’s a problem: A poor score can mean higher interest rates, reduced choice of lenders, or even rejection.

How to avoid it: Check your credit report with a free service, fix any errors and avoid taking out new loans or credit cards before applying for a mortgage.

4. Not Researching the Local Area

The mistake: Choosing a property based solely on the house itself.

Why it’s a problem: Poor transport links, high crime rates or a lack of local amenities can hurt both your lifestyle and future resale value.

How to avoid it: Visit the area at different times of day, look at crime statistics, and explore local schools, shops, and transport options.

5. Being Too Slow to Make an Offer

The mistake: Waiting too long to decide.

Why it’s a problem: The UK housing market can move fast – hesitation can cost you the home you want.

How to avoid it: With your mortgage AIP ready and your budget set, you can make a competitive offer quickly when you find the right property.

6. Only Speaking to Your Bank for a Mortgage

The mistake: Assuming your bank will offer the best deal.

Why it’s a problem: You may miss out on lower interest rates or better mortgage terms available from other lenders.

How to avoid it: Use a mortgage broker who can search the whole market and recommend the best deal for your situation. Read our first time buyer mortgage guide.

✅ Key Takeaways for First Time Buyers

Avoiding these first time buyer mistakes will make your buying journey smoother, less stressful, and potentially save you thousands of pounds.

At Mortgage Links, we help first time buyers secure the right mortgage and guide you through every step of the process – from your first enquiry to getting the keys.

❓ Frequently Asked Questions – First Time Buyers

Q: What’s the difference between an Agreement in Principle (AIP) and a full mortgage offer?

An AIP is a lender’s initial estimate of how much you could borrow based on basic financial information. It’s non-committal, unlike a full mortgage offer which is based on full verification and is legally binding on the lender.

Q: How much deposit do I really need as a first time buyer?

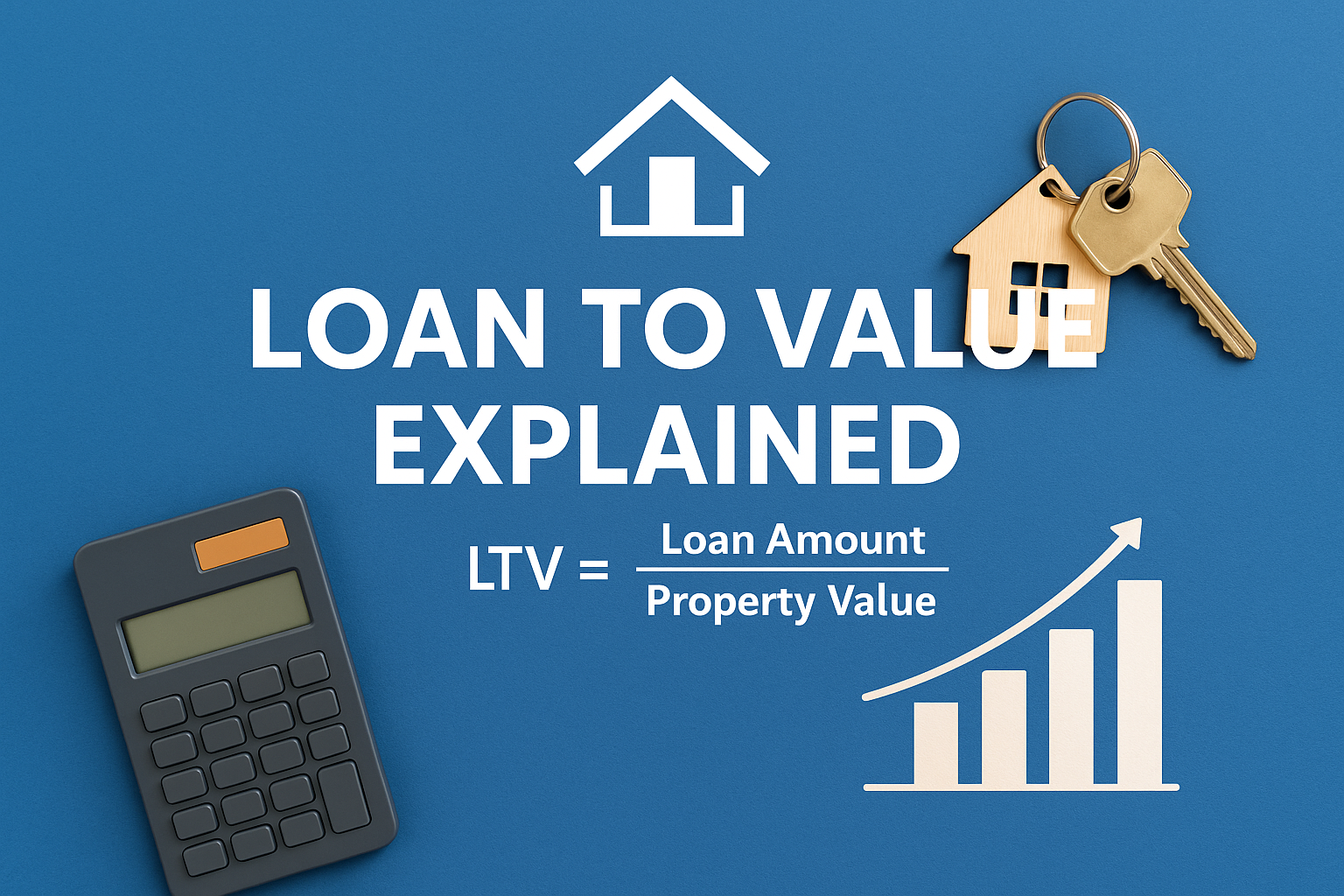

While some lenders accept deposits as low as 0-5%, having 10–20% gives you access to better deals and lower interest rates. Your exact need depends on lender criteria and the type of property.

Q: Are hidden fees common when buying a home in the UK?

Yes—options include valuation fees, solicitor or conveyancing fees and building surveys. These can add thousands, so factor them into your budget early.

Q: Is visiting the area outside working hours really worth it?

Definitely. Checking an area at night, during a weekend, or at rush hour is invaluable to evaluate noise, parking, safety, and the true vibe of the neighbourhood.

Q: Should I always use a mortgage broker?

While you can go straight to your bank, a mortgage broker searches across lenders, potentially unlocking better rates, special products or cashback incentives that banks won’t usually advertise.

🔍 Looking for a Fee-Free Mortgage Broker in Sheffield?

Whether you’re buying your first home, moving up the ladder, or remortgaging — we’re here to make the process simple, stress-free and completely free of charge.

👉 Book your free mortgage consultation now

or

📞 Call us today on 0114 308 6966