If you’re buying a home or remortgaging, you’ve likely heard the term loan to value. In this post, you’ll find loan to value explained in clear, simple language — so you understand how it affects your mortgage options, rates, and approval chances.

💡 What Is Loan to Value (LTV)?

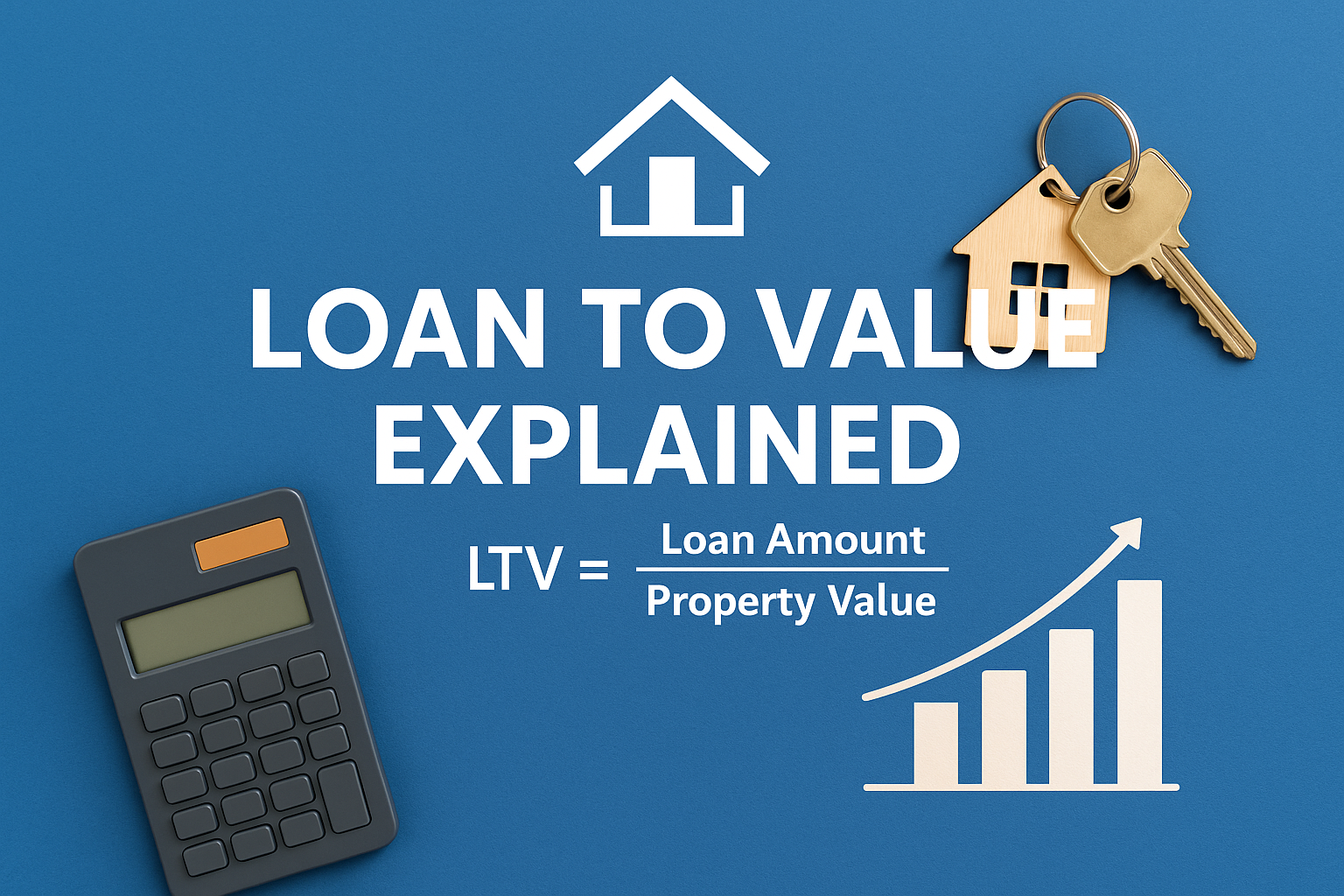

Loan to Value (LTV) is a ratio that compares the size of your mortgage to the value of the property you’re buying. It’s expressed as a percentage and shows how much of the property’s value you’re borrowing.

Formula:

LTV = (Loan Amount ÷ Property Value) × 100

Example:

If your property is worth £200,000 and you borrow £150,000, your LTV is 75%.

Lenders use this number to assess risk — the lower the LTV, the safer the loan appears.

📊 How Loan to Value Affects Your Mortgage

Your LTV ratio plays a major role in:

- The interest rate you’ll be offered

- The deposit you’ll need

- The mortgage products available to you

For example:

- 60% LTV or less: lowest rates

- 75%–85% LTV: standard rates

- 90%+ LTV: higher rates, fewer options

📈 The Relationship Between LTV and Interest Rates

Lenders prefer lower-risk borrowers.

A smaller loan relative to the property’s value means more equity — which reassures lenders that even if prices drop, the loan remains covered.

🏦 Loan to Value Explained in Action — Common Scenarios

- First-time buyers: Often start with higher LTVs due to smaller deposits.

- Remortgagers: May benefit from falling LTVs as property values rise but values can also fall.

- Buy-to-let investors: Typically face stricter LTV caps (around 75%).

Each scenario affects the rates and products you can access.

💬 How to Improve Your LTV Ratio

- Save for a larger deposit

- Buy a property with a lower price

- Overpay your mortgage to reduce your loan balance faster

Even a small deposit increase can shift you into a better LTV band, unlocking lower rates.

⚖️ High vs. Low LTV — Which Is Better for You?

A low LTV means:

- Lower monthly payments

- More mortgage options

- Reduced long-term interest costs

A high LTV may allow you to buy sooner but comes with:

- Higher interest rates

- Greater exposure if property values fall

🔍 LTV and Mortgage Affordability — What Lenders See

LTV is crucial, but it’s not the only factor.

Lenders also assess:

- Your income

- Credit history

- Existing debts

- Affordability under stress tests

So while understanding loan to value explained helps you plan, lenders consider your whole financial picture.

📚 Related Mortgage Concepts You Should Know

- Equity: The portion of your home you own outright.

- Debt-to-Income Ratio: Compares total borrowing to annual income.

- Protection Insurance: Protects your financial position in case of death or ill health.

🤝 Get Expert Mortgage Advice Today

Your Loan to Value ratio directly affects your mortgage rate, affordability, and approval odds.

At MortgageLinks, our advisors can help you find the best mortgage for your situation — and guide you toward a lower LTV for better deals.

👉 Book a free consultation now and start your mortgage journey with confidence.